When you evaluate suppliers for dredging rubber hoses, the decision should begin with a simple engineering question: what conditions must these hoses survive — and what support does a manufacturer need to produce hoses that do so reliably?

Ship-grade performance, not commodity rubber

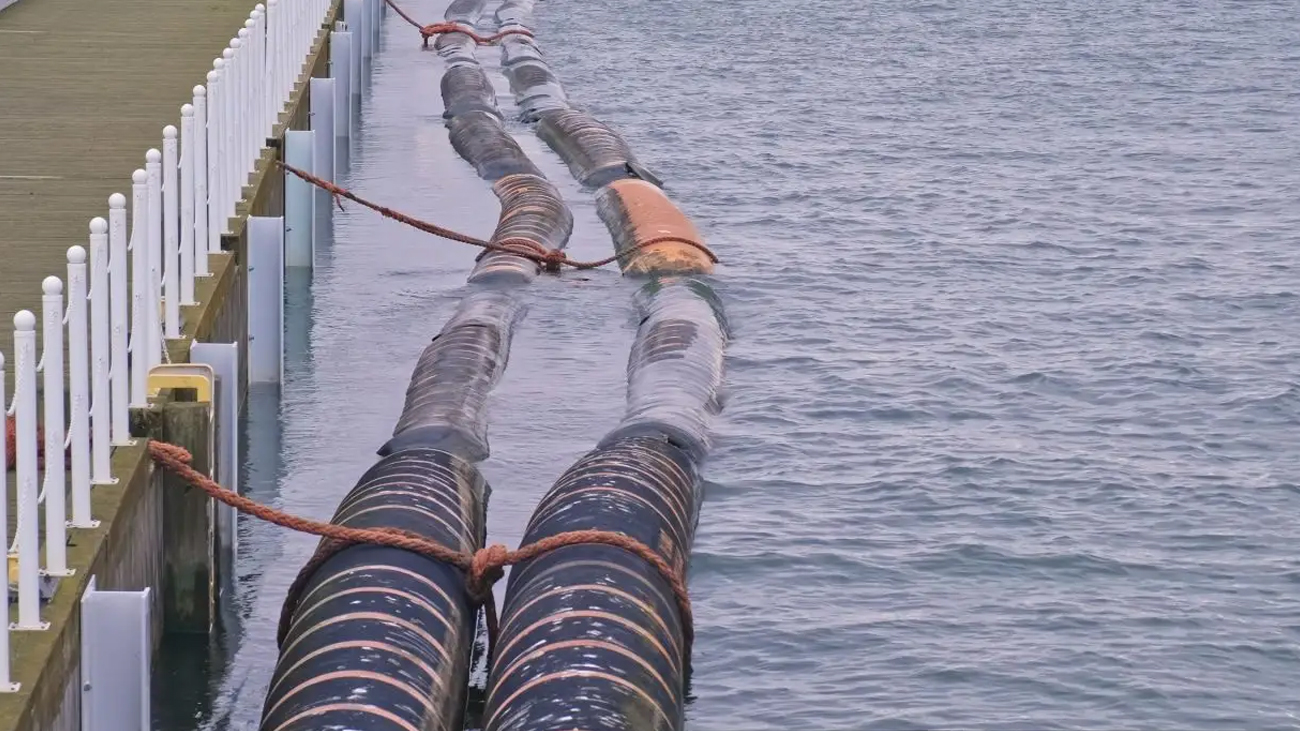

Large dredging and reclamation programs require hoses that do more than carry slurry: they must be engineered to interface with cutter-suction dredgers, amphibious units, booster pump stations and floating pipe systems. That means precise flange dimensions, predictable dimensional stability for large bores, consistent wear-resistant linings, and documented test performance (burst, abrasion, fatigue). These requirements are typical of shipboard or marine-equipment standards rather than of general industrial hose markets.

In short: the market for dredging hoses is a shipbuilding/engineering market. Suppliers who thrive here need to operate to ship-grade expectations, often working alongside dredge pipe suppliers to ensure system integration.

Zhenjiang ( Danyang): the ecosystem that aligns with dredging demands

Zhenjiang — and the nearby Danyang area — sits at a strategic point on the Yangtze River and has developed one of China’s most complete shipbuilding and marine equipment ecosystems. As of 2023 the region supported some 70 ship and marine equipment manufacturers and about 49 specialized ship-support companies. This concentration includes large local players and international names in marine systems, along with a dense network of specialist suppliers and testing resources.

What does that mean in practice?

A deeper engineering understanding of dredging equipment needs

More precise flange, pipe, and system integration standards

Faster customization and technical feedback loop

Higher consistency for large-diameter and long-length hoses

QC standards aligned with marine engineering norms

These are not abstract advantages. They translate directly into more uniform rubber thicknesses, stronger layer bonding, better flange alignment and lower failure rates in long-cycle operations — precisely the performance traits that matter in marine dredging. This is why many dredge hose suppliers focus their efforts here.

Why can't other regions often replicate this dynamic?

Some provinces have many hose factories, and others can undercut on price. But when production is geographically scattered, or when suppliers serve a wide range of low-spec end-markets, several risks emerge: inconsistent compounding, long lead times for specialized inputs, more frequent outsourcing/triage of production steps, and weaker in-region testing support. For one-off project needs or complex dredging systems, these gaps materialize as quality and schedule risk — the very items you cannot afford in large reclamation or continuous pumping campaigns.

Pay a modest premium for far less risk

Because Zhenjiang / Danyang’s manufacturers are embedded in shipbuilding and marine equipment networks, hoses from this area typically command a 10–20% premium versus lower-cost regions. But for project buyers that premium buys:

Fewer unplanned replacements

Better fit with dredger systems and pumping equipment

Easier access to technical documentation and approval evidence

Faster, locally available problem-solving when issues appear on site

Viewed as total cost of ownership, the regional premium is risk mitigation — and in marine dredging, risk mitigation is often the most profitable investment. This includes advanced products such as self floating hose and specialized ship sealing solutions.

Looking for a Trusted Supplier in the Zhenjiang/Danyang Region?

Danyang Yonghong Marine Rubber is based in this exact industrial cluster and offers:

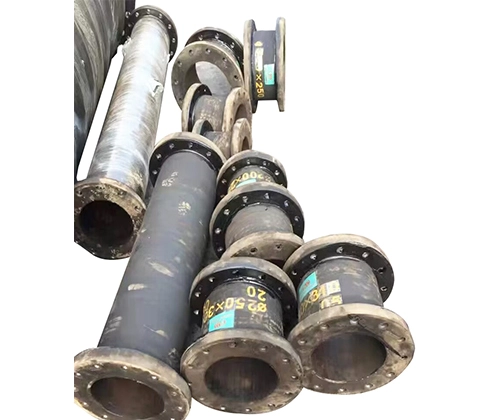

Floating hoses, discharge hoses, suction hoses, armored hoses, and customized assemblies, including dredge hose for sale tailored to project requirements

Marine-grade materials designed for high-wear dredging applications and marine fender China quality standards

Technical drawings and test reports for engineering approval

Reliable export support and on-time delivery

If you need technical consultation, samples, or a quotation for an upcoming project, we are ready to support you with a dependable solution.

Popular Insights into Dredging Hoses and Sealing Elements

- Understanding the Regional Distribution of Dredging Rubber Hose in China

- Common Failure Modes in Dredging Rubber Hoses

- Custom Engineered Dredge Hose Solutions for Bulk Purchases

- Maximizing Efficiency and Safety in Tailings Dredging

- Applications of Polymer Materials and Composite Materials in Marine Rubber Seals

- The Role of Sewer Seal Rings in Marine Pollution Prevention

English

English